Buy Verified TransferWise Account

If you’re looking for a way to send money internationally without being charged exorbitant fees, TransferWise is the answer. With TransferWise, you can set up an account and link it to your bank account. Then, when you need to send money abroad, simply transfer the amount you need into your TransferWise account.

The recipient will then be able to receive the funds in their local currency. Best of all, TransferWise charges a fraction of the fees that traditional banks charge for international money transfers. So if you’re looking for a cheaper, faster way to send money internationally, Transfer Wise is the way to go.

What is Transfer wise

TransferWise is a money transfer service that allows users to send and receive money internationally at the mid-market exchange rate. The company was founded in 2011 by Estonians Taavet Hinrik us and Kristo Käärmann and is headquartered in London, United Kingdom. As of September 2019, TransferWise has over 7 million customers in 49 countries and has processed over £4 billion in transfers.

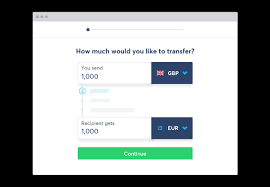

How it works: TransferWise allows you to send money abroad using the real exchange rate. The ‘real’ exchange rate is the mid-market rate, which is the fair price between buyers and sellers of currency, without any markups or hidden fees.

To use TransferWise, you need to create an account and link your bank account or debit card. You can then choose how you want to pay – with a bank transfer or your debit card – and what currency you want to convert into. Once you’ve set up your payment, all you need to do is enter how much money you want to transfer and where you want it sent.

Your recipient will get their funds within 1-2 days (depending on where they live). Why use TransferWise? The main reason people use TransferWise is because they offer better rates than traditional banks – up to 8x cheaper than what most banks charge.

Banks typically add a margin onto the mid-market rate, which means they make a profit on every international transaction made through them. By not adding any extra margins or fees onto the exchange rate, TransferWise can offer significantly lower prices than most banks out there. Another big benefit of using TransferWise is that they are authorised by financial regulators around the world, which means your money is always safe and protected (unlike some other companies who aren’t regulated).

They also have 24/7 customer support available if anything ever goes wrong with your transfer.

How Does Transfer wise Work

In order to understand how TransferWise works, it is important to first understand the traditional way that international money transfers work. When you send money internationally, your bank will typically use something called the SWIFT system. SWIFT is a network that connects banks together so they can easily send and receive money from one another.

The problem with using SWIFT for international money transfers is that it can be very slow (taking up to 5 days for the transfer to go through) and it can be very expensive, with banks often charging hidden fees of up to 5%. This is where TransferWise comes in. TransferWise is a new way to send money internationally.

With TransferWise, you never actually have to use the SWIFT system at all. Instead, your money is transferred using the local banking system in each country. This means that transfers with TransferWise are both much faster (usually taking less than 2 days) and much cheaper (with fees often being less than 1%).

In addition, because your money never has to leave its country of origin, there are no foreign exchange rates to worry about – which means you always get the real mid-market exchange rate when you use TransferWise.

Is It Safe to Use Transfer wise

Yes, it is safe to use TransferWise. They are a licensed money transmitter and have been endorsed by many publications, including The New York Times, Forbes, and The Economist. They use the real exchange rate when transferring your money and have low fees.

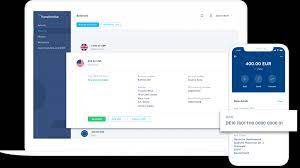

You can also set up a borderless account which gives you a local account number in multiple countries so you can receive payments without any fees.

What are the Benefits of Using Transferwise

Assuming you are asking about the money transfer service: TransferWise is a money transfer service that allows users to send and receive money internationally at the real exchange rate. The company was founded in 2011 by Taavet Hinrikus and Kristo Käärmann and is headquartered in London, United Kingdom.

The main benefit of using TransferWise is that it offers competitive exchange rates compared to other money transfer services. Additionally, TransferWise is transparent about its fees, which are typically lower than those charged by banks for international money transfers. Another benefit of using TransferWise is that it offers a variety of different payment methods, including bank transfer, debit card, and credit card.

If you are looking for a cheap and efficient way to send or receive money internationally, then TransferWise may be the right choice for you.

How Much Does It Cost to Use Transferwise

When it comes to making international money transfers, there are a few different options available to you. You can use your bank, you can use a wire transfer service, or you can use a service like TransferWise. So, how much does it cost to use TransferWise?

TransferWise is a bit different than your typical money transfer service in that they don’t charge any hidden fees or markups on the exchange rate. That means that you’ll always know exactly how much your transfer is going to cost before you even begin. The only fee that TransferWise charges is a small percentage of the amount being transferred (typically around 0.5%).

This makes them one of the most affordable options out there when it comes to international money transfers. And, if you’re transferring large amounts of money, their fee structure could end up saving you quite a bit of cash.

Transferwise Verification Problem

If you’re having trouble verifying your identity with Transferwise, don’t worry – you’re not alone. Many users have been experiencing the same problem. The good news is that there are a few things you can do to try and resolve the issue.

First, make sure that you’re using the latest version of the app. If you’re not, update it and try again. If that doesn’t work, try deleting the app and reinstalling it.

If those steps don’t work, the next thing to do is reach out to Transferwise support. They should be able to help you troubleshoot the issue and get things sorted out. In the meantime, if you need to send or receive money, there are other options available.

You could use a different money transfer service or even just send a traditional bank transfer. Whatever works best for you!

Transferwise Id

If you’re looking to send money abroad, you’ll need to have a Transferwise account. In order to sign up for an account, you’ll need to provide some personal information, including your name, date of birth, and address. One of the things you’ll also need is a government-issued ID.

There are a few different types of IDs that you can use: passport, driver’s license, or national ID card. If you have any questions about which ID to use, you can always contact Transferwise support. Once you’ve gathered all the required information, signing up for your account is easy and only takes a few minutes.

Wise Verification Process

There are a few different things to consider when verifying the identity of an online customer. The first is to make sure that the customer is who they say they are. This can be done through a number of methods, including requiring the customer to provide their social security number or other government-issued ID, running a credit check, or using third-party verification services.

The second thing to consider is whether the customer is able to pay for the goods or services they’re requesting. This can be verified by checking their credit score, employment history, or bank account balance. Finally, it’s important to make sure that the shipping address and contact information provided by the customer are valid and up-to-date.

This can be done by contacting the customer directly or using third-party verification services. By following these steps, you can help ensure that your online customers are who they say they are and that you’re not getting scammed.

Reviews

There are no reviews yet.